Working from home (WFH) – a symptom of, not a solution to planning failures and what it means for Sydney property buyers

July 17th, 2023

As Sydney buyers’ agents we have been monitoring this issue for several years. Only now, in this the second of our series of insights into macro and micro influences on the Sydney property market, can we give you our assessment of WFH’s impact on the present and future Sydney residential and commercial property markets.

Should WFH influence your property buying decisions?

While it can’t be ignored, we believe residential and other property buyers should in general, not put too much weight on WFH when deciding for example, whether it is worth paying a premium for properties close to CBD’s or public transport.

WFH – game changer or long blip?

Widespread WFH began as a response to the pandemic. It de-stigmatised and quickly legitimised work practices for many which were previously the practices of a few (about 6%).

Equally quick have been the phases of WFH as the pandemic receded.

Initially, some thought WFH ushered in fully remote working for large swathes of the workforce.

That thought gave way to a ‘consensus view’ that hybrid WFH two to three days per week, was here to stay.

Despite the appeal of WFH for many, the reality is that even the hybrid model is broadly now under pressure which is exposing in some sectors a potentially ugly contest between employers and employees as reflected in a recent disparity between required and actual attendance rates at several major Australian employers of which these are recent examples:

| ASX ranking (by market cap) | Company | Minimum office requirement | Actual attendance (average) |

| 1 | BHP | 2-3 days a week | 2-3 days a week |

| 2 | CBA | 50% | 45% |

| 3 | CSL | 25% | 2-3 days a week (anecdotal) |

| 4 | NAB | 2-3 days a week | 1-2 days a week average |

| 6 | ANZ | 50% | < 50% |

Source: AFR

This contest between labour and capital has seen the Finance Sector Union refer CBA’s 50% requirement to the Fair Work Commission as well as extract an agreement from the NAB giving all employees the right to request to work from home and appeal “unreasonable” refusals.

WFH has also pulled some public sectors in different directions: while Australia’s 176,00 public servants won the right not to have limits imposed on the number of days they can WFH, Randwick City Council has recently ordered its clerical staff back into the office full time.

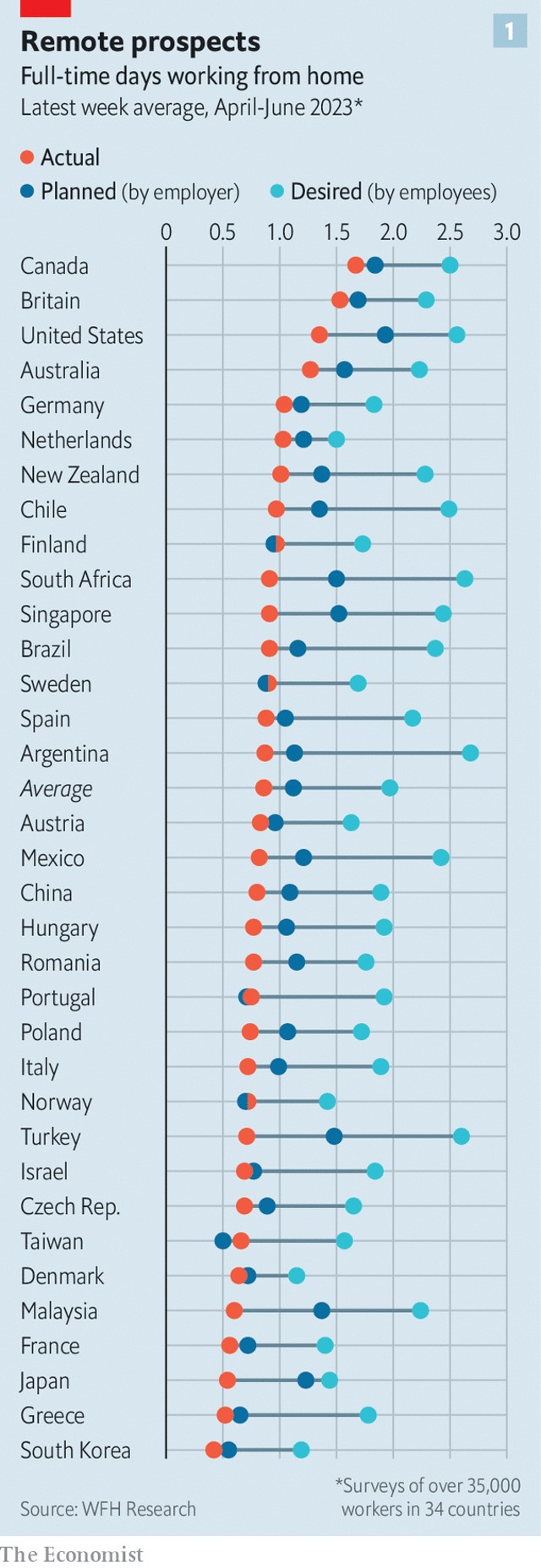

And as The Economist discussed in a 10/7/2023 article entitled “The Fight over Working from Home goes Global” (the Economist article), the issue is indeed global:

“Remote work has a target on its back…With bosses clamping down on the practice, the pandemic-era days of mutual agreement on the desirability of remote work seem to be over…Across the world, plans for remote working by employers fall short of what workers want, according to WFH Research, a group that includes Stanford University and the Ifo Institute, a German think-tank, which has tracked the sentiment of full-time workers with at least a secondary education in 34 countries.

Until recently, as firms tried to lure workers during the post-pandemic hiring bonanza, employees’ demands and employers’ plans seemed to be converging in America, the best-studied market. This convergence is tailing off. At the same time, the pandemic has entrenched [WFH] patterns…Those practices will not be easy to unwind.”

In our opinion, those practices will eventually unwind in Sydney and sooner than some believe.

It’s all about productivity and unemployment

Productivity

As also discussed in the Economist article “[c]orporate bosses fear that fully remote work dents productivity, a worry reinforced by a slew of recent research. One study of data-entry workers in India found those toiling from home to be 18% less productive than their office-frequenting peers; another found that employees at a big Asian it firm were 19% less productive at home than they had been in the office. Communication records of nearly 62,000 employees at Microsoft showed that professional networks within the company ossified and became more isolated as remote work took hold.”

Australian studies are to the same effect including most recently by Australian National University, University of Newcastle and Macquarie University which found that in 2022 productivity and professional efficacy both dropped when people were WFH and were more anxious, depressed and lonely.

As reported in the 18/6/23 AFR , according to co-author Kieron Meagher, an economics professor at ANU, “while some studies found [WFH] had increased the productivity of software engineers and other occupations that required a high degree of focused or independent work, the outcomes were much more negative when a wider variety of white-collar occupations were studied.”

That conclusion mirrors earlier findings by Swinburne University …”that designating certain days for remote work can [also] enhance individual productivity, when it involves routine business-as-usual, task-based work [but that]…for more interactive, collaborative endeavours focused on complex work, the office environment is irreplaceable.”

Similar to comments made by urbanists such as Richard Florida and others, the SMH’s Ross Gittins summed it up as long ago as 24/8/2021:

“Any lasting change in the way we work is likely to be evolutionary rather than revolutionary…[as] produced by the interaction of various conflicting but powerful forces.

After all, it would be a return to the way we worked 300 years ago before the Industrial Revolution. Then, most people worked from home…And, don’t forget, by today’s standards we were extremely poor.

What’s made us so much more prosperous? …What underlying force pushed us in the direction it did? …our pursuit of improved productivity… [which] isn’t producing more, it’s producing more with less…

[I]n 250 years of installing ever-better “labour-saving technology” we’ve managed to increase unemployment only to 6 per cent or so. That’s because automation doesn’t destroy jobs, it changes and moves them. From the production of physical goods to the delivery of human services. In the process, it’s made us hugely better off.

It was the Industrial Revolution that increasingly drove us to the centralised workplace…]which]…provided a means for bosses to co-ordinate activity in real time, supervise workers and it also provided an efficient way to share knowledge”…

So the central workplace reduced the cost of combining labour and capital, but did so by imposing transport costs…

This, of course, is why we fancy the idea of continuing to [WFH]. It’s only advances in computing and telecommunications technology that have made this possible. The cost of moving information has plummeted, while the cost of moving workers – in time and discomfort – has gone up.

So, could it be that modern communications technology is set to drive us back to our homes?

Perhaps. But remember this. While the tiny proportion of people [WFH] has hardly budged over the past two decades, our capital city CBDs have become more significant as centres of economic activity and as engines of productivity improvement.

Here’s the catch. At the same time as information technology was improving, and the cost of communicating over distance was falling, the nature of work was changing. As machines have replaced routine tasks, modern jobs have come to require more open-ended decision-making, critical thinking and adaptability.

Experts think these quintessentially human skills are best developed and honed though face-to-face interactions, such as the serendipitous encounter or the tacit knowledge we absorb through observing those around us…

Economic history suggests that what evolves will be the combination that maximises our productivity. Not just because bosses want to make bigger profits, but also because most people like a rising standard of living.”

Closely related to productivity concerns are what eminent company structure economist, the late Ronald Coase referred to as increases in co-ordination costs caused by any activity making collective enterprise more unwieldy.

Widespread WFH involves such costs.

For example, WFH discussions tend to overlook the obvious fact that most of those upon whom the pandemic initially forced WFH were already trained and working in non WFH environments so were able to adapt pre existing skills.

Not so however for at least two years’ worth of new starters lacking those skills who began their careers without the in person mentoring, shadowing and other agglomeration effects their older peers enjoyed and which remote learning cannot replicate.

That cohort began their careers with a skills deficit which would not have occurred with in office training and relevantly, will incur additional costs to remedy. Learning twice rather than once on the job.

Equally obvious and overlooked is the minefield of OH&S issues raised by enterprise bargaining and other agreements enshrining a right to WFH such as those discussed earlier.

Homes and kitchen tables are not designed or monitored as work spaces, safe or otherwise. Some are fluid or shared households of short duration.

How can employers be expected to discharge their work, health and safety obligations to potentially thousands of employees working from as many changing spaces those employers neither provide nor control?

Even before considering the massive and ongoing co-ordination costs of those exercises as well as potentially staggering insurance premiums and complex legal issues, this issue alone might prevent such agreements being registered by the relevant Commonwealth and State bodies rendering them a populist but pyrrhic victory for unions.

Unemployment

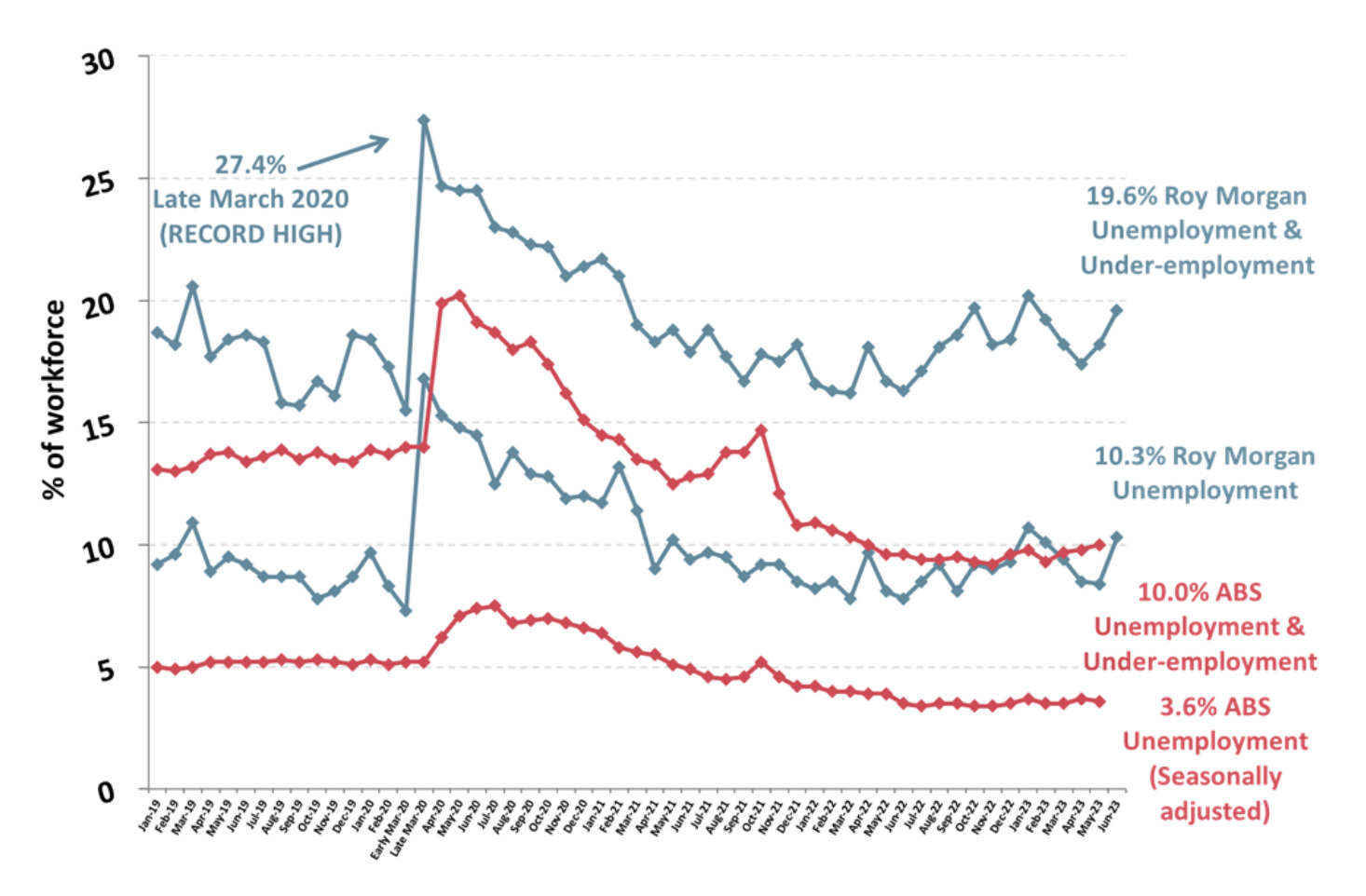

It is rising and at a rate disguised by the official ABS statistics.

This is reflected in the following graph from the 30 June 2023 Roy Morgan employment series which concluded that “[c]ompared to early March 2020, before the nation-wide lockdown, in June 2023 there were more than 800,000 more Australians either unemployed or under-employed (+4% points) even though overall employment (13,634,000) is almost 800,000 higher than it was pre-COVID-19 (12,872,000):

However and as several have noted including John Kehoe in the 12/6/23 SMH …” [a] cocktail of rising [Australian] wages and woeful labour productivity is poised to jack up unemployment and cause businesses to replace workers with cheaper machines.”

To quote again from the Economist article: “[i]t is no coincidence that the crackdown on remote work is happening as the labour market begins to cool. Deepening job cuts across Wall Street and Silicon Valley have handed power back to businesses. However, even in tech and finance some employees are standing their ground… The question is whether the bosses or the bossed will yield the most.”

In addition to the impact of rising interest rates only now working their way through the system, further erosion of the employee bargaining power to dictate from where they will work is the proposed influx into Australia of skilled migrants.

How is this playing out in Sydney?

While there will be exceptions depending on the industry or profession, based on the evidence discussed below, we believe the majority of the bossed are yielding and will continue to do so.

Substantial Australia wide post pandemic drop in job advertisements offering WFH

Purpose Bureau is an organisation using proprietary algorithms to track the hiring activity of every business in Australia. It has investigated the status of WFH in March 2021 (after the first 12 months of COVID restrictions) compared to March 2023 to provide some “insight into how much of the emerged WFH arrangements were a temporary measure as opposed to a permanent change in Australian workplaces.”

The results, particularly relevant to CBD’s with a high proportion of white collar workers such as Sydney, North Sydney and Parramatta, were as follows:

Number of WFH job ads per 10,000 job advertisements

| Sector | March 2023 | March 2021 | % Change between March 2021 and 2023 | ||

| Other Services | 371 | 439 | -15 | ||

| Financial and Insurance Services | 789 | 1175 | -33 | ||

| Health Care and Social Assistance | 1502 | 1570 | -4 | ||

| Professional, Scientific and Technical Services | 1871 | 2360 | -21 |

Source: Property Bureau

This isn’t 1990 for Sydney CBD commercial property

In September 2022, the Australian Property Journal noted:

“The current rise in office vacancies, is being compounded by strong office supply, as well as a drop in demand. Feedback from stakeholders, such as workforce strategists, tenant advocates, leasing agents and property owners, suggests there is no clear trend emerging from Australia’s major office occupiers in taking less space in current lease negotiations. While some companies are taking less space, due to increased [WFH], some are taking additional space to create space for collaboration and social distancing.” (emphasis ours)

Despite concerns that Sydney CBD commercial property may be over valued as suggested by two recent larger but B grade building sales at around 20% below their book value, a clearer picture of the bigger buildings is obscured by extremely low sales volumes which, in itself suggests post pandemic resilience.

The sectors showing signs the other way are B and lower grade buildings and some smaller, strata titled offices which we think presently offer excellent buying opportunities.

One thing is clear: Premium and A-grade Sydney CBD office buildings with strong green credentials are faring well especially in the Central Core.

While sub leasing is on the rise even in some new developments including the Salesforce Tower, such space is also likely to be absorbed by a natural increases in the office worker population.

Similarly and in addition to the re purposing of older buildings discussed later, newer businesses enticed by lower rents, may absorb those B and lower grade buildings especially in the Mid Town, Southern and Western Corridor precincts.

For some perspective, it’s a far cry from Sydney’s CBD during the 1990’s recession with the SMH reporting in March 1992 “[t]he Sydney CBD vacancy rate is expected to peak at 20 per cent in late 1993 and the oversupply will inhibit significant rental growth until 1996.”

Substantial post pandemic drop in “home office” keyword search term in NSW real estate advertisements on Domain

According to Domain in May 2022, its review of keywords used in property searches revealed “home office” was “no longer a priority.”

Strong post pandemic upward trend in public transport usage to and from Sydney’s CBD

Source: Transport for NSW

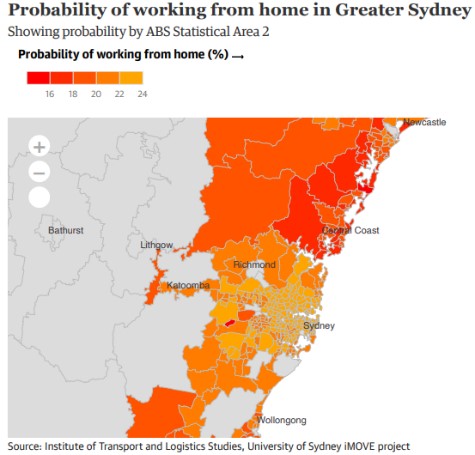

The above graph aligns with a travel survey by the Institute of Transport and Logistics Studies in the University of Sydney Business School which found that “in September 2022…[a]lmost all occupations worked less from home than they did in March 2022.”

WFH re-stigmatised

We call it ‘invisibility anxiety’ as explained in this anecdote from an inner city white collar worker:

I’ve been WFH in my marketing job for three years but now with the talk of redundancies I’ve decided that I need to be in the office more so I’m more visible. I can’t afford to lose this job as I’m trying to get citizenship. Once they were urging us to buy on the Central Coast and WFH but now the vibe is ‘be here or lose your job.’”

Related to this are anecdotal and other concerns that WFH reduces promotion opportunities.

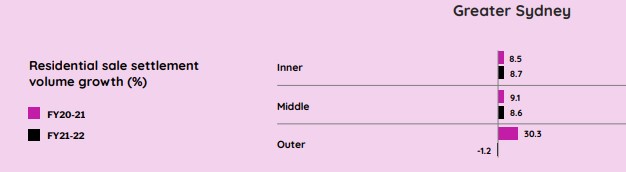

The reverse donut

When the pandemic began, many fled the city for the regions in what became known as the ‘donut effect.’

By mid 2022, the trend reversed creating a ‘reverse donut effect’ as many returned to the centre.

That trend was consistent with our prestige property buying experience in the Blue Mountains and northern Illawarra where and despite good and relatively close CBD access via rail and toll roads, listings generally have increased and prices have fallen.

The following settlement figures from PEXA say it all:

The reverse donut effect also exposes another but usually unremarked irony: whilst reduced commuting times is the most commonly cited appeal of WFH, the inner city has the highest probability of residents to be WFH whereas the outer ring suburbs are those experiencing both the greatest mortgage stress partly because of long and expensive commutes resulting from poor planning and whose populations are also predominantly in occupations which cannot work from home such as construction, healthcare, education, hospitality and essential services.

Sydney’s falling crime rate

Another relevant consideration is the local crime rate. According to a 23/6/23 Economist podcast “Averting the City Death spiral”, one of the reasons San Francisco’s CBD is struggling to recover from the pandemic is a failure to stop the high crime rate in that city. In contrast and as discussed in the SMH on 2/7/23, as an example “[i]n the 12 months to March 2022, Sydney’s murder rate per person dropped to a record low…and fell again this year.”

Post pandemic wave of up market restaurant openings in Sydney’s CBD

Hardly a week goes by without the lifestyle media heralding the opening of a new and expensive restaurant despite an industry wide shortage of skilled hospitality workers and many others who and again because of historical planning failures, are unable to afford the costs of accommodation closer to the city.

Re purposing older CBD buildings and the new State Government

In a potential silver lining to the WFH cloud still hanging but lifting over Sydney’s CBD, calls are now being made for re purposing vacant, older office blocks into affordable residential accommodation.

While the Sydney CBD has a history of such re purposing since the mid 1990’s, that history is not deep and pandered to planning controls which rendered prestige apartments the highest and best use of such buildings eg:

| Current Sydney building | Former use |

| The Domain, 22 Sir John Young Crescent, Wooloomooloo | ANZ Funds Management |

| Highgate, 127 Kent Street | Esso |

| Observatory Tower, 168 Kent Street | IBM |

| Stamford on Kent, 183 Kent Street | Caltex |

| The Residences, 16 College Street, Darlinghurst | NSW Police HQ |

| Griffiths Teas, 46 Wentworth Avenue, Surry Hills | Griffiths Teas |

| Castlereagh, 111 Castlereagh Street | David Jones |

The new State Government, whose influence over Sydney’s property market we highlighted last month , is looking at older buildings as a way of easing the critical housing supply shortage with NSW Housing Minister, Rose Jackson telling The Guardian on 17/5/23:

“Everything is on the table. If there are opportunities to do that [repurpose buildings for affordable housing] in a way that aren’t unbelievably expensive, we’re keen”…

Jackson also hinted that incentives for developers would be considered if there was a proposal that would turn the building into more than just a series of cubicle like apartments.

Given that prestige residential has to date been the highest and best re purposed use of such buildings, any incentives and/or government subsidies would need to be substantial before conversions of such buildings to affordable housing or even build to rent, become viable.

Rapid recovery of tourism and hospitality

Two years ago, pundits were predicting a long lasting downturn in this now booming segment which recently included the $520 million purchase by billionaire Andrew Forrest and family of the new Waldorf Astoria at Circular Quay.

Sydney’s rental crisis

According to CoreLogic, in the 12 months to 30/6/23, average Sydney unit rents increased a massive 17%. One consequence of this, yet another regulatory failure which opening the migration floodgates will only compound, is an increase in the size of households. Such flat sharing has also had unintended productivity sapping consequence for many city workers such as this CBD solicitor who complained to us that “it’s impossible to WFH and keep business information confidential from my flatmates when we’re all sharing a small unit doing the same thing.”

Final word

Far from killing off the cities and all of us WFH or living on donuts, post pandemic experience is reinforcing the importance of the centre and confirming the urgent need to look for other solutions to years of failed planning controls.